Executive Summary

Shipment tendering—the process of inviting, evaluating, and awarding freight bids—has traditionally been plagued by manual inefficiencies, high error rates, and lack of scalability. Rapid advances in logistics technology, especially digital platforms, AI, and automated Transport Management Systems (TMS), are transforming how supply chain leaders navigate these challenges. This guide details actionable best practices, real-world outcomes, and step-by-step processes to maximize operational efficiency, minimize risk, and deliver quantifiable ROI in digital shipment tendering.

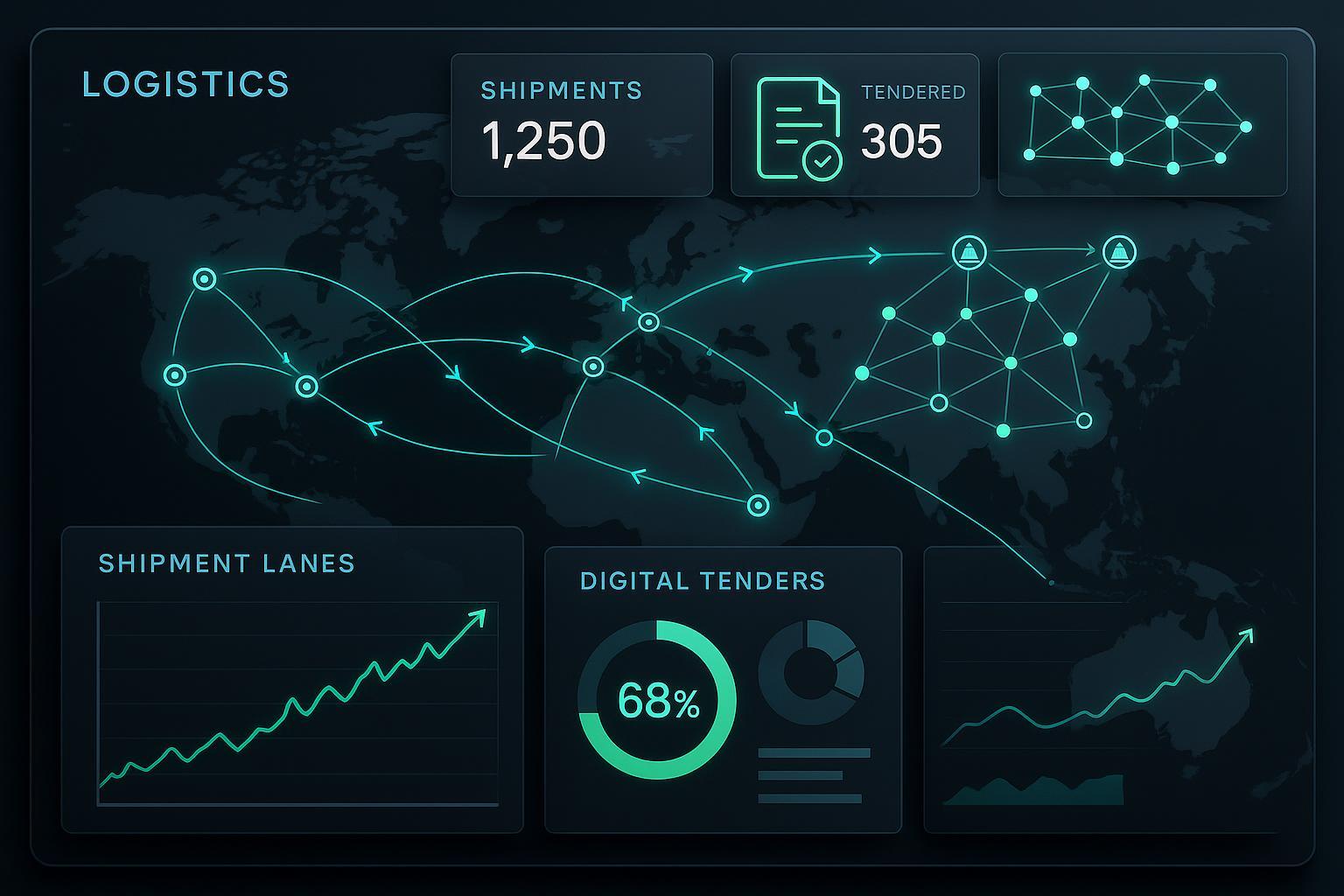

The Shipment Tendering Challenge: Why Change Is Non-Negotiable

Manual shipment tendering is resource-intensive and error-prone:

- Manual bid reviews delay cycle times and increase labor costs.

- Limited carrier visibility means missed savings and higher spot market risk.

- Fragmented spreadsheet workflows result in lost data and audit gaps. Recent benchmarking shows digital shipment tendering can reduce working hours by up to 50% (PUMA/Freightos), save $110–$200 per load (IntelliTrans), and cut total truckload spend by 2–3% (Project44).

Technology Landscape: Key Enablers

Modern shipment tendering is driven by several core technologies:

- Algorithmic TMS: Dynamic, rules-based carrier selection using real-time data and predictive analytics.

- AI & RPA Automation: Smart bid workflows, exception handling, and repeat execution—at scale.

- Digital Tendering Platforms: End-to-end coordination, vendor-neutral integrations, and performance benchmarking.

Tool Comparison Table

| Platform | Core Use Case | Key Features | Real-world Evidence |

|---|---|---|---|

| IntelliTrans TMS | Algorithmic/dynamic tendering | Real-time rules, predictive analytics, cost controls | $110–$200 savings/load |

| Keelvar | AI-powered sourcing for complex events | Automation, multi-lane/multi-carrier bid optimization | Used by Carlsberg, CJLA |

| Project44 | Freight procurement analytics | Carrier benchmarking, multi-modal automation | 2–3% truckload spend reduction |

References: IntelliTrans, Keelvar, Project44

Step-by-Step Best Practice Workflow

Below is a structured best practice checklist for digital shipment tendering—each step summarized for maximum operational impact.

1. Pre-Tendering: Data Readiness & Integration

Begin with robust data hygiene and systems integration to ensure all shipment, rate, and carrier data is accurate and visible.

- Standardize data formats (EDI/API) for seamless flow.

- Conduct an audit of carrier pools and historical bid outcomes.

- Integrate TMS/eTendering platforms with ERP and order management systems.

2. Workflow Digitization: Platform Onboarding & Configuration

Onboard key stakeholders and configure digital workflows that reflect business rules and tender types.

- Define tendering algorithms (least-cost, allocation, service-based).

- Train teams on automation triggers and exception protocols.

- Map the end-to-end tender cycle (pre/post-award) within the platform.

3. Real-Time Analytics & Bid Automation

Leverage real-time analytics to automate bid invitations, carrier decisions, and exception routing.

- Automate mini-bids and spot negotiation to reduce market volatility.

- Use predictive analytics to rank carriers and scenarios for each lane.

- Monitor acceptance rates and response times in dashboards.

4. Exception & Escalation Protocol

Deploy automated exception handling management for rejected, delayed, or incomplete bids.

- Route exceptions for review with built-in escalation workflows.

- Maintain audit trails for compliance and later optimization.

5. Post-Award Analytics & Continuous Improvement

Analyze tender results, cost savings, cycle times, and spot market exposure after each award.

- Benchmark performance against internal goals and external market data.

- Refine rules, carrier pools, and automation workflows based on outcomes.

- Use dashboards and reporting tools to sustain process excellence.

Visual Checklist: Digital Shipment Tendering Best Practices

| Step | Action Summary | KPI / Result |

|---|---|---|

| Data Integration | Cleanse data, enable system connectivity | Higher accuracy, fewer errors |

| Onboarding & Configuration | Train teams, set rules, map cycles | Fewer manual interventions |

| Bid Automation | Automate invites/responses, predictive selection | Faster cycles, lower spend |

| Exception Handling | Enable automated escalation and audits | Reduced errors, better compliance |

| Post-Award Analytics | Continuous benchmarking and workflow refinement | Measurable ROI improvement |

Pitfalls & Solutions

Common pitfalls—and how to avoid them:

- Inadequate system integration: Causes data gaps. Solution: Prioritize API/EDI connectivity and cross-system audits.

- Underestimating change management needs: Can derail adoption. Solution: Invest in stakeholder training and phased rollouts.

- Ignoring exception handling: Raises risk. Solution: Embed escalation paths and audit logs from day one.

- Failing to benchmark performance: Solution: Regularly compare outcomes to industry data and revise processes accordingly.

Quantifiable Benefits: Real-World Impact

Case Study Highlights:

- PUMA (via Freightos Procure): 50% reduction in procurement working hours; hundreds of cost optimization actions automated; fast bid execution (source).

- IntelliTrans TMS: $110–$200 average cost reduction per load; increased acceptance rates; less spot market dependence (source).

- Keelvar Platform: Accelerated tender cycles, higher repeatability, improved decision quality for large enterprise events (source).

Actionable Summary & Next Steps

To streamline shipment tendering and prove ROI:

- Clean and integrate your operational data.

- Select a platform that supports dynamic tendering, AI, and automation.

- Map all workflows—digitally—before launching.

- Prioritize automation and exception escalation in daily operations.

- Benchmark and refine continuously for measurable gains.

Further Reading & Key References

- Freightos: PUMA Case Study

- IntelliTrans: Algorithmic TMS Tendering

- Project44: Freight Procurement Technology

- Keelvar: Transport Tendering in Practice

Citation policy: All data and cases referenced above are independently sourced from published case studies, analyst reports, and recognized industry platforms (see above resource links).