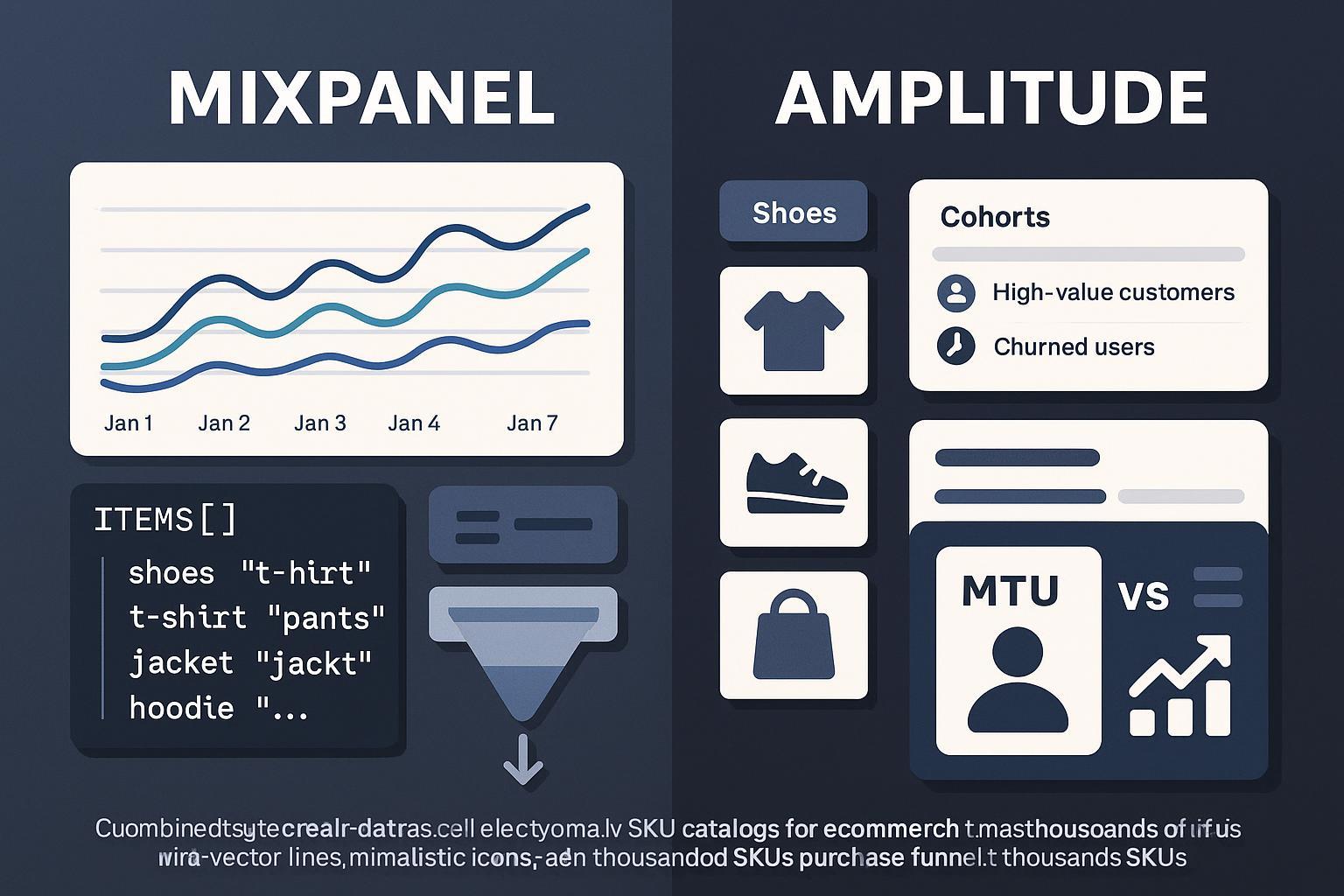

If you run an ecommerce business with tens of thousands (or millions) of SKUs, the analytics tool you choose will shape everything from merchandising decisions to campaign targeting. The hard part isn’t just “which has more charts,” but whether the platform handles item arrays, SKU-level detail, identity stitching, and cost exposure without slowing to a crawl—or blowing up your budget.

This 2025 comparison focuses on what actually matters for large catalogs: data modeling for items[] and cardinality, governance, identity resolution, query performance at high cardinality, pricing exposure (events vs MTU), warehouse integrations, and ease of rollout. Where pricing or limits are mentioned, we cite the vendor’s official pages with dates and encourage a final check before you buy.

Quick comparison (at a glance)

| Platform | Core strengths | Constraints/watchouts | SKU/cardinality handling | Pricing model | Identity | Governance | Warehouse sync | Best for |

|---|---|---|---|---|---|---|---|---|

| Mixpanel | Fast, self‑serve product analytics; flexible JSON properties and items arrays; strong cohorts; real‑time feel | Avoid top‑level high‑cardinality properties; learn truncation behaviors; follow tracking plan | Keep SKU/product_id nested in items[]; use brand/category at top level; JSON flattening supported | Event‑based; as of Feb 2025, Free and Growth both include 1M monthly events at $0 up to the cap (verify current terms) | Simplified ID Merge (anon→known) recommended since 2024 | Lexicon + Data Standards for tracking plans and schema definition | Warehouse Connectors (Snowflake/BigQuery/Redshift/Databricks); Data Pipelines export | Teams wanting event‑based economics, fast cohorts, strong governance with flexible schema |

| Amplitude | Robust cohorts and activation; experimentation and session replay options; strong identity model | MTU + event allowances interplay matters on browse‑heavy sites; confirm plan caps/retention | Keep SKU/product_id inside nested properties/items; avoid high‑cardinality breakdowns at top level | MTU‑centric with event limits; plan caps/retention vary—confirm on pricing/limits pages | Amplitude ID merges device_id and user_id; anon history attaches at login | Data/Taxonomy with Data Planning playbooks and verification | Export/import with GCS/S3 and warehouses; warehouse‑native best practices published | Growth/CRM teams emphasizing engagement/experimentation and activation tied to cohorts |

Evidence anchors in sections below explain these points and provide 2024–2025 references.

Data modeling at scale: items arrays, variants, and cardinality

For high‑SKU catalogs, your biggest risk is cardinality sprawl. The safer pattern is:

- Put detailed identifiers (SKU/product_id, variant_id) inside the purchase event’s items[] array.

- Use rollups (category, collection, brand) as top‑level properties on frequent events like Product Viewed.

- Only break down by SKU when you need item‑level insight—otherwise stay at category/brand to keep queries fast and stable.

Mixpanel supports JSON/object properties and will flatten nested fields during ingestion, which is how purchase events can carry an items array with item‑level details. The docs describe JSON properties and flattening behavior in warehouse-connected pipelines, and the Mixpanel blog’s event analytics primer references an "items" property on purchase events in 2025. See the 2025 documentation and blog discussion in the Mixpanel sources: the warehouse connectors page outlines JSON handling, and the primer mentions items on purchases in the 2025 post (Mixpanel Docs — Warehouse Connectors, accessed 2025-09-16; Mixpanel Blog — Event analytics, 2025-04-17).

Amplitude’s SDKs and docs similarly support nested properties for commerce events, including productId, price, and quantity within a structured revenue object. While there isn’t a single “canonical ecommerce schema” doc, the SDK references and feature guides imply and support the pattern of nesting item details rather than promoting SKU to a top‑level property used in frequent breakdowns (Amplitude iOS Swift SDK, accessed 2025-09-16; Amplitude Browser SDK 2, accessed 2025-09-16).

Practical do’s/don’ts:

- Do: Attach items[] to Purchase Completed (with product_id/SKU, quantity, price, variant, category).

- Do: Add top‑level brand/category on Product Viewed and Add to Cart for clean rollups.

- Don’t: Send SKU as a top‑level property on every Product Viewed if you have 100k+ SKUs; that will explode cardinality and slow breakdowns.

Governance and data quality: preventing schema drift

With thousands of SKUs and frequent product refreshes, taxonomy drift can erode trust. Both vendors offer governance features, but they use different language:

- Mixpanel: Lexicon and Data Standards let you publish a tracking plan, define event/property owners, and enforce types and naming. Mixpanel outlined these governance practices in 2025 posts and implementation guides (Mixpanel Blog — Data Standards, 2025-04-16; Mixpanel Docs — Implement your tracking plan, accessed 2025-09-09).

- Amplitude: Data/Taxonomy and the Data Planning Playbook walk through verification states, cleanup, and naming conventions, with community checklists for remediation. These resources were updated through 2024–2025 (Amplitude Docs — Data planning playbook, accessed 2025-09-16; Amplitude Community — Data cleanup checklist, 2024-10-23).

Tip: Assign owners for the core ecommerce events (Product Viewed, Add to Cart, Checkout Started, Purchase Completed). Gate new properties through reviews to avoid unplanned high‑cardinality fields.

Identity resolution: anonymous to known without data loss

You need pre‑login browsing tied to post‑purchase LTV. Both platforms support anonymous → known stitching:

- Mixpanel’s Simplified ID Merge (default for new projects since 2024) uses $user_id and $device_id with automatic merging, removing the need for legacy alias patterns. It allows multiple device IDs per user and simplifies identity sequencing (Mixpanel Docs — ID management overview, accessed 2025-09-10; Mixpanel Docs — Migrating to Simplified ID Merge, accessed 2025-09-16).

- Amplitude creates a unified Amplitude ID that merges device_id (anonymous) and user_id (known). When a user logs in, anonymous history attaches to the known profile. This is also crucial for experimentation to avoid variant jumping (Amplitude Docs — Track unique users, 2024-06-11; Amplitude Docs — Variant jumping, 2025-09-03).

Implementation tip: Test identity transitions in staging and production. Verify that post‑login events reference the same logical user, cohorts don’t double‑count, and experiments remain consistent across devices.

Performance at high cardinality: breakdowns, truncation, and “hot shard” limits

Even with good modeling, high‑SKU breakdowns can stress the UI. Plan for:

- Top‑N truncation in charts when a breakdown has too many distinct values. Mixpanel surfaces banners and CSV limits in reports. Practical workaround: filter to a brand or category first, or pivot in the warehouse for deep SKU‑level analysis (Mixpanel Docs — Reports overview, accessed 2025-09-10).

- Ingestion safeguards. Mixpanel documents per‑identifier daily volume protections—“hot shard limits”—to keep storage balanced and queries responsive (e.g., per distinct_id/day caps). These aren’t typical ecommerce blockers, but they’re useful to know during load tests (Mixpanel Docs — Hot shard limits, accessed 2025-09-13).

- Warehouse‑native best practices on Amplitude: if you adopt warehouse‑native patterns, avoid very high‑cardinality clustering keys and design schemas to keep cost and latency under control (Amplitude Docs — Warehouse‑native best practices, accessed 2025-09-16).

Bottom line: For routine dashboards, break down by brand/category and use filters. Reserve SKU‑level pivots for targeted queries or the warehouse.

Pricing and limits: how exposure differs for browse‑heavy catalogs

The economics differ meaningfully for high‑SKU ecommerce.

-

Mixpanel is event‑based. As of the Feb 3, 2025 pricing update, Mixpanel states that the Free plan continues to include 1M monthly events, and the Growth plan “now starts with 1M events per month included for free,” with usage under 1M on Growth costing $0 (check the post for current wording and any plan caveats). See the official announcement in 2025 for details (Mixpanel Blog — Pricing update, 2025-02-03).

-

Amplitude is MTU‑centric with event allowances. The official materials emphasize MTUs (monthly tracked users) with plan‑specific limits and overage rules. The company notes that all organizations have a monthly event volume limit and that exceeding it can result in overage fees; retention varies by plan, with examples like Plus offering two years of data access. Verify the latest caps and features on the official docs before purchase (Amplitude Docs — Limits, accessed 2025-09-16; Amplitude Docs — Plus plan FAQ, accessed 2025-09-10; also see the Amplitude Blog — Free platform, 2024-12-19, for positioning and plan context).

Worked exposure example (illustrative, not a price quote):

- Traffic model: 5M monthly Product Detail Page views, 200k Add to Carts, 50k purchases, mostly anonymous browsing.

- Event‑based exposure (Mixpanel): Costs scale with total events you send. If you autocapture clicks and scrolls, volume grows fast—so use sampling or limit non‑essential events.

- MTU exposure (Amplitude): Costs correlate more with unique active users than total events, but there are event limits per plan. On browse‑heavy sites where the same users view many SKUs, MTU models can be favorable; on sites with massive anonymous drive‑by traffic (unique MTUs spiking), MTU costs can rise. Always map your real MTUs and events to each plan’s caps before committing.

Guidance: Model both scenarios with your data. If your MTUs are relatively stable but event volume is huge (autocapture, many interactions), MTU pricing may be attractive. If you have a broad audience with many one‑time visitors but fewer interactions per user, an event‑based model can be more predictable.

Integrations and data movement: joining analytics with merchandising and margins

You’ll almost certainly join analytics with catalog, inventory, and margin data in a warehouse.

-

Mixpanel offers Warehouse Connectors to import data from Snowflake, BigQuery, Redshift, and Databricks. Sync modes include Mirror (CDC/CDF), Append, Full, and One‑time. For exporting analytics back to storage/warehouse, Mixpanel’s Data Pipelines support JSON and schematized exports on an ongoing cadence (Mixpanel Docs — Warehouse Connectors, accessed 2025-09-16; Mixpanel Docs — Data Pipelines, accessed 2025-09-16).

-

Amplitude supports destinations like Google Cloud Storage and sources like BigQuery, along with guidance for data mutability in warehouse‑native setups (INSERT/UPDATE/DELETE to keep datasets consistent) (Amplitude Docs — GCS destination, accessed 2025-09-09; Amplitude Docs — Data mutability, accessed 2025-09-14; Amplitude Docs — BigQuery source import, accessed 2025-09-11).

Ecommerce platform notes: Mixpanel’s Shopify guidance suggests combining the Shopify Web Pixel with Mixpanel SDK for conversion coverage due to checkout restrictions, reflecting that you’ll design your own schema rather than rely on a turn‑key app (Mixpanel Docs — Shopify, 2025-03-20). Amplitude provides a Shopify app with prebuilt dashboards and add‑ons like session replay and experimentation, but schema details are not fully public on the listing (Shopify App Store — Amplitude, accessed 2025-09-15).

Ease of rollout: autocapture vs a rigorous tracking plan

Autocapture can jump‑start visibility, especially for lean teams, but unmanaged autocapture increases noise and cost:

- Mixpanel introduced Autocapture in 2025 for the web JS SDK. It logs common interactions (page views, clicks, form submits, scrolls, rage clicks) and includes privacy controls. Use it to discover what matters, then graduate key events into your tracking plan (Mixpanel Docs — Autocapture, accessed 2025-09-16; Mixpanel Changelog — Autocapture, 2025-02-04).

- Amplitude offers Autocapture via the Browser SDK and Visual Labeling (no‑code definitions by clicking UI elements). It’s convenient for bootstrapping, but be mindful of event volume and cross‑origin constraints (Amplitude Docs — Visual labeling, accessed 2025-09-15; Amplitude Browser SDK 2, accessed 2025-09-16).

Recommended rollout path:

- Start with limited autocapture to surface patterns.

- Define a tracking plan for critical events and properties, with owners and validation.

- Add warehouse syncs for catalog enrichment and downstream BI.

- Monitor event volumes and cardinality; throttle or sample low‑value events.

Scenario‑based recommendations

There isn’t a universal winner; fit depends on traffic mix, catalog scale, and data maturity. Here’s how to think about it:

-

Browse‑heavy, many interactions per user but stable MTUs

- Consider Amplitude. An MTU‑centric model can be efficient if the same users generate lots of events (clicks, variant views) but your unique monthly actives don’t spike. You also get tight ties to experimentation and activation workflows.

-

Broad reach with many one‑time visitors, fewer interactions per user

- Consider Mixpanel. An event‑based model can be more predictable when MTUs are volatile, as long as you manage autocapture volume and avoid sending overly granular events on high‑traffic pages.

-

Merchandising teams living in category/brand rollups with periodic SKU deep dives

- Either platform works if you model correctly (items[] for purchases; brand/category top level). Favor the UI your team finds faster for day‑to‑day segments. Trial both with real data and test breakdown latency at your scale.

-

Data‑mature orgs with a warehouse‑first strategy

- Both support warehouse import/export and mutability/mirror sync patterns. Evaluate which connector modes align best with your data engineering stack and SLAs. If your team prefers to centralize SKU‑level analysis in the warehouse, UI speed differences matter less.

-

Teams emphasizing experimentation and activation tied to cohorts

- Amplitude’s experimentation and activation ecosystem may tip the balance if these workflows are central. Confirm plan requirements and data retention before committing.

How to choose: a quick checklist

- Catalog scale: 10k, 100k, or 1M+ SKUs? Commit to items[] on purchases; avoid SKU top‑level on frequent events.

- Traffic mix: Are MTUs stable but events high? Or are MTUs spiky with fewer events per user?

- Identity maturity: Can you reliably merge anonymous to known across devices? Pilot identity flows in both tools.

- Warehouse posture: Do you need mirror/mutable syncs and routine exports to BI/finance?

- Team resourcing: Do you have owners to enforce a tracking plan and governance, or will you lean on autocapture initially?

FAQs

-

Should I store SKU at the top level of Product Viewed?

- Generally no for large catalogs. Keep SKU/product_id inside items[] on purchases and use brand/category at the top level for frequent events to control cardinality. Both vendors support nested properties for item detail (Mixpanel Docs — Warehouse Connectors, accessed 2025-09-16; Amplitude Browser SDK 2, accessed 2025-09-16).

-

How do these tools merge anonymous browsing with logged‑in behavior?

- Mixpanel’s Simplified ID Merge auto‑merges $device_id with $user_id for new projects since 2024. Amplitude merges device_id history into the user profile via the Amplitude ID when user_id appears (Mixpanel Docs — ID management overview, accessed 2025-09-10; Amplitude Docs — Track unique users, 2024-06-11).

-

Can I sample events to manage costs?

- Sampling is a viable strategy for low‑value interactions when policy allows, but be careful with metrics that feed revenue or conversion rates. Always document your sampling rules in the tracking plan and monitor bias.

-

Do both support Shopify?

- Both work with Shopify, but approaches vary. Mixpanel advises pairing Shopify Web Pixel with Mixpanel SDK for end‑to‑end coverage due to checkout constraints, implying a custom schema approach. Amplitude offers a Shopify app with prebuilt dashboards; verify event coverage and plan requirements (Mixpanel Docs — Shopify, 2025-03-20; Shopify App Store — Amplitude, accessed 2025-09-15).

Bottom line

- Structure your schema to contain SKU‑level cardinality inside items[].

- Use governance to prevent drift as your catalog evolves.

- Map your actual MTUs and event counts to each platform’s pricing and limits.

- Test breakdowns at your real scale, not sample data.

If you pilot both tools with your true traffic patterns and catalog depth, the right fit usually becomes obvious within a couple of weeks.