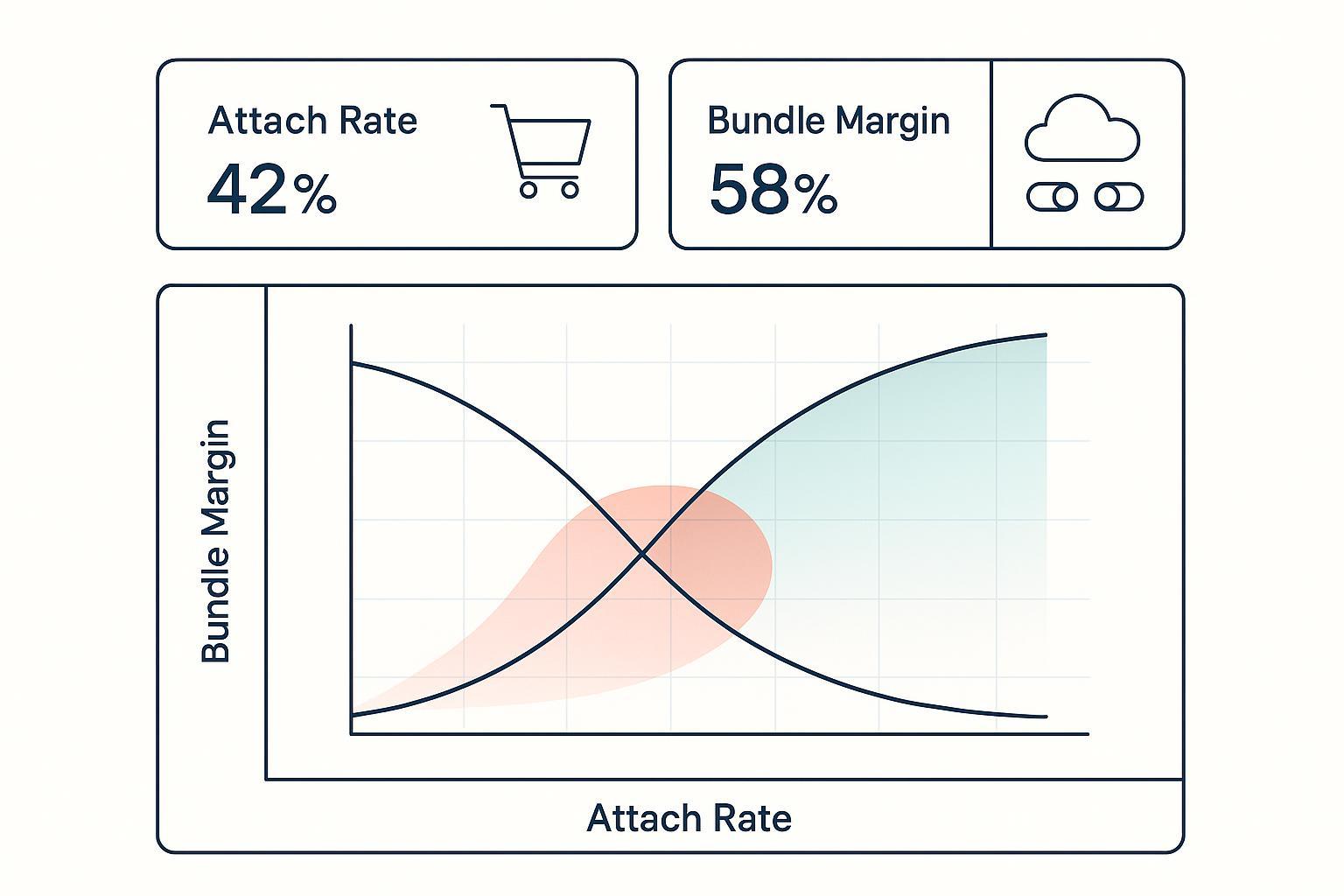

If you’ve launched bundles in eCommerce or SaaS, you’ve probably celebrated a rising attach rate—only to be surprised when profit didn’t move. In 2025, the teams winning with bundles are the ones balancing attach rate with margin rules and making contribution profit—not adoption— their north star. This guide distills what consistently works across real launches and iterations.

Key idea: Attach rate is a growth lever; margin rules are the safety system. Your operating model needs both.

Definitions that matter (and how to measure them)

- Attach rate (eCommerce, order-level): Orders containing the bundle or attached add-on ÷ total orders. Track by bundle/SKU and channel. This aligns with how enterprise retailers manage cross-sell/add-on behaviors to lift add-to-cart and AOV, as discussed in Shopify’s enterprise guidance on product page optimization and add-to-cart levers in 2024–2025 according to Shopify enterprise product page guidance.

- Attach rate (SaaS, customer/subscription-level): Customers or subscriptions with add-ons/premium bundle ÷ total active customers/subscriptions. This sits alongside ARPU and NRR in subscription monetization models covered in 2024–2025 packaging overviews like Stripe’s SaaS pricing models 101.

- Bundle gross margin %: (Bundle price − bundle COGS) ÷ bundle price. For retail, include product COGS and variable costs like fulfillment and payment fees. Retail math and costing conventions are summarized in 2024–2025 guides such as Shopify’s retail math overview.

- Contribution margin (bundle-level): Bundle revenue − variable costs (COGS, fulfillment, payment/marketplace fees, packaging, support). This is the primary profit signal to optimize.

Tip: Track attach rate at both cohort and channel levels (e.g., PDP vs checkout, email vs paid social) and segment by product/plan to see where attach responds to offer design without wrecking margins.

The operating principle: optimize contribution profit, not attach rate

- Attach rate can go up while profit goes down. Discounts and cannibalization are the usual culprits.

- Make contribution profit per session/order (retail) or per account/month (SaaS) your objective function. Attach rate, AOV/ARPU, and gross margin are the decision variables.

- Guardrails prevent “winning” on adoption while quietly bleeding margin.

According to 2024–2025 pricing practice, many retailers hold a ≥30% gross margin floor after discounts and variable costs, which aligns with retail-math norms discussed in Shopify’s retail math overview. Mature SaaS businesses commonly target 70–80%+ gross margins; AI usage-heavy features require careful monetization to avoid margin compression, as noted in 2024–2025 packaging commentary like Paddle’s guidance on pricing AI features.

Set explicit guardrails and targets

Minimum rules I recommend setting before launch:

- Margin floor by segment

- Retail/eCommerce: Bundle gross margin ≥ 30% after all variable costs (common in practice per retail math norms; tune for your category) as summarized in Shopify’s retail math overview.

- SaaS: Bundle/plan gross margin ≥ 70–80% (typical for mature software), adjusted for usage-based costs on AI/compute per 2024–2025 SaaS pricing commentary like Paddle’s AI pricing guide.

- Cannibalization threshold (internal): Define acceptable share of bundle sales that displace higher-margin standalone items or plans. If breaches persist, redesign the bundle. Strategy firms emphasize modeling cannibalization explicitly in bundling decisions per 2024–2025 guidance such as Simon‑Kucher’s bundling strategy overview.

- Refund/chargeback or churn guardrails: If bundle variants increase refunds or SaaS churn above tolerance, pause the test.

Target setting:

- Establish a baseline attach rate by channel/segment for 2–4 weeks.

- Define a target uplift (e.g., +5–10 pts attach) and a hard cap on allowable margin dilution (e.g., −2 pts gross margin max) per variant.

- For SaaS, set ARPU uplift targets alongside attach rate to avoid low-value attachments.

Calibrate pricing with discount bands and value packaging

Discounts are a blunt instrument. Your goal is to find the minimum discount (if any) that achieves target attach without violating margin floors.

Practical steps:

- Map elasticities using discount bands at 5%, 10%, 15%, and 20% off sum-of-parts. Smaller discounts for strongly complementary items; larger bands only when value perception is weak—an approach consistent with bundling best practices from 2024–2025 such as Simon‑Kucher’s bundling guidance.

- Test packaging without discount: Rename, reframe, and add a minor perk (priority support, extended warranty, setup, or content) to raise perceived value before cutting price. McKinsey’s 2024–2025 work on experience-led growth indicates cross-sell lifts when value is clearly communicated and personalized, not only discounted, as summarized in McKinsey’s experience-led growth perspective.

- Anchor with a simple price comparison: Sum-of-parts vs bundle price, plus the top 2–3 value bullets in copy.

Decision rule: Choose the lowest band that meets attach targets while keeping contribution margin above your floor. If none do, recompose the bundle.

Measurement model and dashboard you can deploy this week

Primary KPIs

- Attach rate (by bundle/SKU or add-on, by channel/placement)

- Conversion rate for the affected funnel step (PDP, cart, checkout, post‑purchase)

- AOV (retail) or ARPU (SaaS)

- Gross margin % (bundle-level) and contribution margin per order/account

- Net impact: contribution profit lift per 1,000 sessions or per 100 orders/accounts

Guardrail KPIs

- Refund/return rate (retail), chargebacks

- Churn and downgrade rate (SaaS)

- Cannibalization ratio: share of bundle sales substituting for previously higher-margin options

Recommended dashboard cuts

- By channel (e.g., email, PDP, checkout, post‑purchase modal)

- By customer segment (new vs returning; SMB vs enterprise)

- By device (mobile vs desktop)

- By timeframe/cohort (weekly, monthly)

Most modern commerce stacks can support this with native analytics plus a BI layer. Shopify continues to expand out‑of‑the‑box profit and custom reporting capabilities (2024–2025) per the Shopify analytics updates and enterprise analysis guides such as Shopify’s enterprise data analysis primer.

Experimentation in 2025: do it right or don’t do it

- Pre‑specify power and significance. Aim for 80–90% power and 95% significance. Modern experimentation platforms provide sequential testing to allow earlier, valid stops. Vendors like VWO document their stats engines and guardrails in 2024–2025 product notes such as the VWO stats engine and reporting update.

- Define stop‑loss rules tied to guardrails: e.g., pause any variant if margin < floor for two consecutive days at sufficient sample.

- Use post‑purchase attach surfaces. For retail, test PDP, in‑cart, checkout, and especially post‑purchase upsell placements. For SaaS, test upgrade modals, onboarding checklists, and account‑based prompts.

- Personalize when possible. Firms report higher cross‑sell lifts from tailored offers; 2024–2025 CX research points to personalization as a key lever for attach without steep discounts, per McKinsey’s experience-led growth perspective. Optimizely’s 2024–2025 product updates also highlight integrated experimentation and personalization workflows in Optimizely’s personalization updates.

eCommerce vs SaaS: where the math differs

- Cost structure

- Retail bundles have tangible COGS, fulfillment, payment fees, returns, and marketplace commissions—track all in variable cost. Retail math conventions for 2024–2025 are summarized in Shopify’s retail math overview.

- SaaS bundles often carry high gross margins but watch for usage-based costs (compute, API calls, model inference). Pricing AI-heavy features demands careful value/usage alignment, per 2024–2025 guidance like Paddle’s AI pricing guide.

- Metrics focus

- Retail: AOV, attach by placement, contribution per 1,000 sessions, refund rate.

- SaaS: ARPU uplift, add-on attach by cohort, NRR, churn/downgrade impacts.

- Packaging levers

- Retail: Complementary SKU pairing, seasonal kits, warranty/setup services.

- SaaS: Feature gating, add-on modules, bundles by job-to-be-done, seat tiers.

- Billing mechanics

- SaaS stacks (Stripe, Paddle, Recurly) support add-ons, tiered pricing, and cohort analytics, enabling attach tracking at the subscription level. See 2024–2025 overviews like Stripe’s SaaS pricing models 101, Paddle subscriptions and metrics, and Recurly’s bundle pricing overview.

Risk patterns and how to mitigate them

- Margin erosion

- Symptom: Attach rate up, contribution profit flat/down.

- Fix: Recompose bundles around higher-margin items/services; switch from discount to value packaging; enforce floors with automated alerts.

- Reference: Value‑based pricing and careful rollout reduce margin loss and backlash; see 2024–2025 primers like Simon‑Kucher on value‑based pricing.

- Cannibalization of profitable standalones or higher‑tier plans

- Symptom: Bundle sales rise while premium plan/hero SKU mix drops.

- Fix: Introduce fences (eligibility rules), reshape bundle composition, or increase bundle price. Bundling strategy guidance emphasizes modeling cross‑effects, per Simon‑Kucher’s bundling strategy overview.

- Bundle fatigue and decision overload

- Symptom: Many bundles, lower conversion, confused customers.

- Fix: Limit visible options, rotate seasonally, communicate value succinctly. Loyalty/pricing integration to keep the proposition clear is highlighted in 2024–2025 retail research like McKinsey’s loyalty and pricing insight.

Real‑world snapshots to benchmark your approach

- eCommerce AOV and attach behaviors: Case materials in the Shopify ecosystem reported a ~21% AOV lift for a jewelry retailer via cross‑sell/bundle widgets—directional evidence that smart attach surfaces can move the needle when paired with merchandising discipline, per 2024–2025 enterprise ecosystem discussions like Shopify’s pricing strategy discussion.

- B2B personalization and post‑cart add‑ons: Shopify’s enterprise content cites examples where targeted post‑cart add‑ons drove incremental revenue without heavy discounting, reinforcing the placement/personalization lesson for 2024–2025, as summarized in Shopify’s B2B personalization guidance.

- Channel bundling and operational impact: Parachute’s case shows how integrated channel strategy (e.g., BOPIS) scaled with notable growth over four years, reflecting how operational bundling grows revenue while managing cost-to-serve, per the 2024 case write‑up Shopify case: Parachute.

Note: Public data with both attach rate and margin side‑by‑side is scarce in 2024–2025; use your internal tests to build benchmarks and compare to these directional outcomes.

A simple decision tree for bundle variants

- Does the variant lift attach rate to target? If no, kill or redesign.

- If yes, does contribution margin per order/account stay ≥ floor?

- If no, try lower discount or recompose items/features; retest.

- If yes, proceed.

- Is cannibalization within threshold and NRR/AOV up on a net basis?

- If no, add fences, reposition, or raise price.

- If yes, scale.

Scale rule: Don’t scale a bundle variant until it wins on attach, contribution margin, and cannibalization simultaneously.

The weekly operating rhythm that keeps you honest

- Monday: Review last week’s attach, AOV/ARPU, margin, and net contribution across variants by channel/segment.

- Tuesday–Wednesday: Ship one new bundle variant or pricing/packaging iteration (max one variable at a time).

- Thursday: Check guardrails and early read; do not stop early unless sequential test criteria are met (VWO/Optimizely provide these guardrails; see the 2024–2025 VWO stats engine update and Optimizely personalization updates).

- Friday: Summarize learnings; make keep/kill/iterate decisions; queue next week’s test.

Formulas and quick math you’ll use often

- Attach rate (order‑level): orders with bundle ÷ total orders.

- Attach rate (subscription‑level): subscriptions with add‑on/premium ÷ total active subscriptions.

- Bundle gross margin %: (bundle price − bundle COGS) ÷ bundle price.

- Contribution margin per order: bundle revenue − variable costs (COGS, fulfillment, payments, returns, marketplace fees, packaging, support).

- Net contribution lift per 1,000 sessions: (test contribution ÷ sessions) − (control contribution ÷ sessions) × 1,000.

For SaaS, include unit economics for AI features: if marginal inference cost per active user is meaningful, model contribution margin at the cohort level and enforce fences (usage caps, overage pricing) as recommended in 2024–2025 SaaS pricing primers like Paddle’s AI pricing guide.

Tooling notes (platform‑agnostic)

- eCommerce stacks: Use native analytics to build attach and margin dashboards; Shopify’s 2024–2025 analytics updates make profit and custom metrics easier to track, see Shopify analytics updates. Bundle apps can help with SKU mapping and revenue tracking; evaluate those with built‑in A/B tests.

- SaaS billing/analytics: Implement add‑on SKUs and track adoption/ARPU through billing and revenue tools. Overviews for 2024–2025 billing stacks and metrics include Paddle subscriptions and metrics and Recurly’s bundle pricing overview.

- Experimentation: Choose platforms with sequential testing support and guardrails. See VWO’s stats engine overview and Optimizely’s personalization updates.

What to do Monday morning: a practical checklist

- Baseline

- Pull 2–4 weeks of attach, AOV/ARPU, and margin by channel/segment.

- Identify top 3 placements with highest attach headroom.

- Guardrails

- Set margins floors (retail ≥30%; SaaS ≥70–80% unless usage costs dictate otherwise).

- Define cannibalization tolerance and refund/churn guardrails.

- Design

- Draft 2 bundle variants per segment: one value‑packaged, one minimal discount (5–10%).

- Create clear sum‑of‑parts vs bundle value framing in copy.

- Test

- Pre‑compute required sample size; enable sequential rules; set auto stop‑loss on margin.

- Launch in one surface per week (PDP or post‑purchase for retail; upgrade modal for SaaS).

- Measure

- Track attach, conversion rate, AOV/ARPU, gross and contribution margin, and net contribution lift per 1,000 sessions.

- Segment by new/returning or SMB/enterprise.

- Decide

- Keep if attach target met AND margin floor respected AND cannibalization within threshold.

- Otherwise iterate: adjust composition, presentation, or price band; or kill.

Closing thought

In 2025, bundle success isn’t about chasing a big attach rate—it’s about the disciplined interplay of attach, price, and cost that maximizes contribution profit. Set the guardrails, test small, measure well, and scale only what wins on all fronts.

References for further reading (primary sources):

- Shopify enterprise product pages and add‑to‑cart levers (2024–2025): Shopify enterprise product page guidance

- Retail math and margin calculations (2024–2025): Shopify’s retail math overview

- Shopify analytics updates (2024–2025): Shopify analytics updates

- Enterprise data analysis (2024–2025): Shopify’s enterprise data analysis primer

- McKinsey on experience‑led growth and personalization (2024–2025): Experience‑led growth perspective

- McKinsey on loyalty and pricing (2024–2025): Loyalty and pricing insight

- Simon‑Kucher on bundling strategy (2024–2025): Bundling strategy overview

- Simon‑Kucher on value‑based pricing (2024–2025): Value‑based pricing primer

- Optimizely personalization/experimentation updates (2024–2025): Optimizely personalization updates

- VWO stats engine and guardrails (2024–2025): VWO stats engine and reporting update

- Stripe on SaaS pricing models (2024–2025): Stripe SaaS pricing models 101

- Paddle on subscriptions/metrics and AI pricing (2024–2025): Paddle subscriptions and metrics, Pricing AI features

- Recurly on subscription bundles (2024–2025): Recurly’s bundle pricing overview