If you run a DTC channel for a CPG brand, PPA is one of the few levers that simultaneously moves conversion, margin, and retention. The playbook below distills what consistently works in practice in 2025—no silver bullets, just a proven way to make smarter price/pack decisions and operationalize them fast.

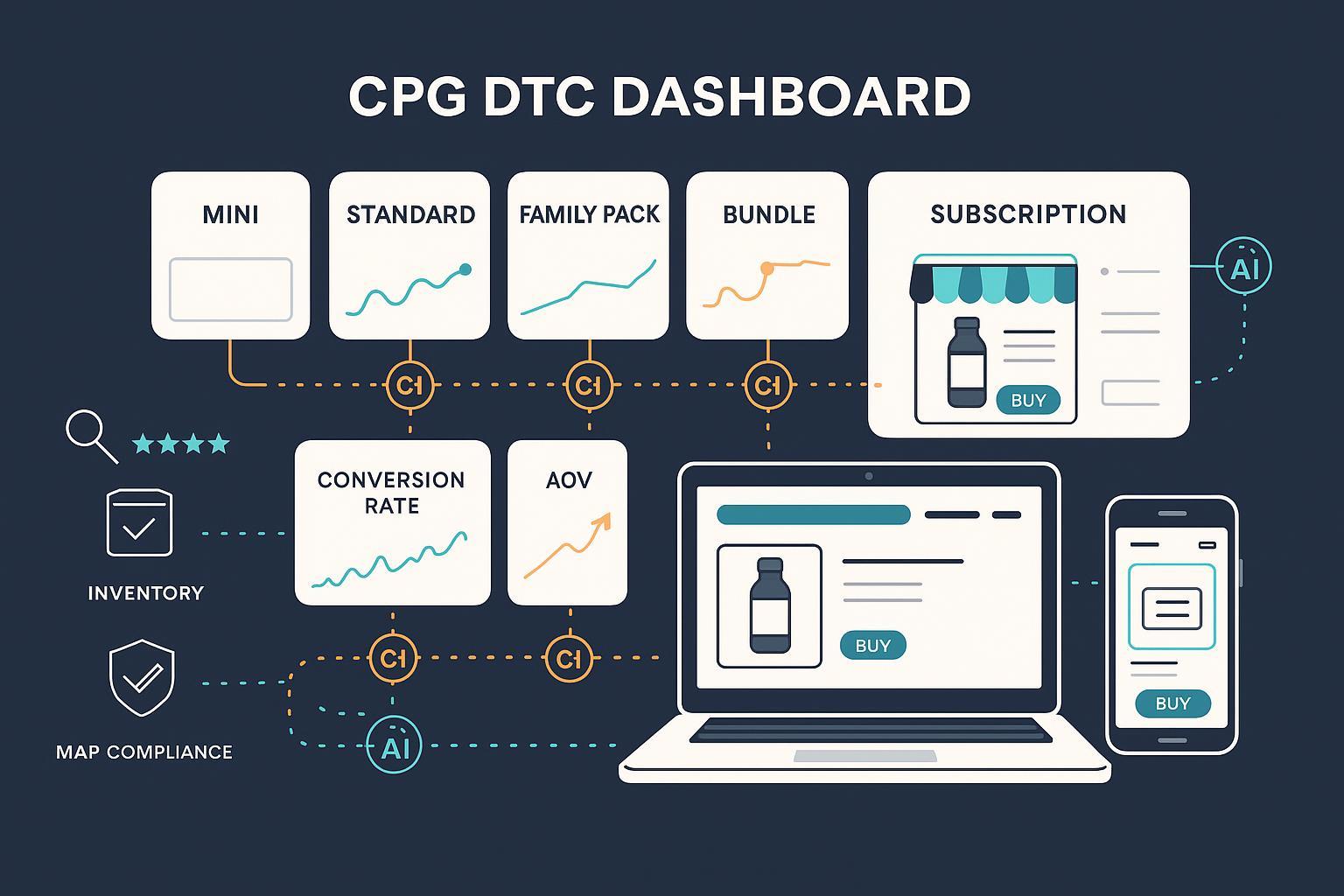

What “good PPA” looks like on a DTC site

On DTC, PPA is not just about hitting psychological price points—it’s about matching need-states with the right formats and price ladders, then learning quickly from real traffic.

- Start from consumer and occasion. OBPPC-style thinking (Occasion, Brand, Pack, Price, Channel) ensures each format has a distinct job on your site; see the channel-aware framing discussed in Buynomics’ perspective on PPA design in 2024–2025 (Buynomics on PPA’s role).

- Use a stepwise playbook: category deep dive, value proposition, price–pack design, financial modeling, go-to-market, and continuous optimization—summarized clearly in the 2023–2025 PPA playbook from Polestar (Polestar PPA playbook).

- Real example of pack strategy: Coca‑Cola’s continued emphasis on smaller, affordable formats (e.g., mini-cans) is documented in 2024–2025 SEC filings and investor materials, reflecting portion-control and affordability positioning that translates well online (see Coca‑Cola 2024 Form 10‑K discussion of packaging mix, filed 2024) (Coca‑Cola 2024 10‑K).

Key takeaway: you’re designing a portfolio that covers “trial,” “everyday,” and “value” tiers with minimal cannibalization, then instrumenting the site to learn and iterate weekly.

Instrument the data foundation before you change prices

In practice, PPA wins and losses are made in the plumbing. Get this right first:

- Clean commerce data: transaction line-items (pack, price paid, discount, tax/shipping), session analytics (attribution, cohorts), COGS and fulfillment costs.

- Experimentation logs: feature flags or A/B test platform IDs, exposure timestamps, audiences, and guardrails.

- Digital shelf signals: share of search, price parity, ratings/reviews volume, and availability. NIQ’s 2024 guides detail the KPIs that correlate with conversion and discoverability (NIQ digital shelf KPIs, 2024). For teams focused on competitive crawl and AI prioritization, Profitero’s playbooks summarize AI-driven digital shelf operations (Profitero on AI-driven digital shelf).

- Governance: MAP policy references, promo calendars, and channel-specific price floors/ceilings in one place.

Minimum viable stack: a unified data layer where you can join cost, demand, promo, and shelf signals to estimate elasticities and simulate scenarios.

Estimate elasticity and willingness-to-pay (WTP) the practical way

The fastest path to decision-quality elasticity estimates on DTC:

- Randomized price tests for your top 5 packs.

- Power for at least a detectable 5–8% relative conversion change; avoid overlapping promos; run 2–4 weeks depending on traffic.

- Geo or cohort experiments where randomization is impractical, using difference-in-differences to control for seasonality.

- Hierarchical Bayesian models to pool information across segments and stabilize estimates for lower-traffic packs. Recent marketing science work shows robust performance of hierarchical Bayes for heterogeneous response estimation across 2023–2024 (SAGE – Hierarchical Bayesian estimation in marketing).

- Conjoint/choice for new packs/bundles, especially when you need WTP for unlaunched formats. If stockpiling or dynamic preferences are relevant, adapt dynamic discrete-choice approaches from recent literature (2024) for better face validity (SSRN – dynamic discrete-choice with stockpiling).

What matters most: estimation discipline (clear priors, sensible floors/ceilings), clean test execution, and rolling updates as you ship changes.

Design your portfolio and price ladders with guardrails

Translate insights into a clear architecture:

- Tiering: Trial (smallest or sample), Core (standard), Value (family/bulk), and Mission-based bundles (e.g., “30‑day reset”). Anchor prices at known thresholds (e.g., sub‑$10, sub‑$25) then validate via tests.

- Cannibalization check: simulate cross-price elasticity impacts before launch. Kill lookalike packs that overlap too much.

- EU unit pricing online: if you sell in the EU, show total and unit price clearly; Directive 98/6/EC requires unambiguous selling and unit prices for consumer goods, applicable to digital contexts (EU Directive 98/6/EC – price indication).

- MAP and parity: document rules, promo blackout windows, and escalation paths; align with retail media plans to avoid whiplash between DTC and wholesale partners. 2024 McKinsey guidance emphasizes integrated RGM governance and proactive price management in inflationary contexts (McKinsey – RGM for sustainable success, 2024).

Decision guardrails: price floors based on unit economics, ceilings from WTP and parity considerations, and automated checks for unit price/labeling compliance by region.

Connect PPA with the digital shelf and omnichannel reality

Your DTC price/pack choices echo across search and marketplaces:

- Feed digital shelf KPIs into your PPA loop: share of search, ratings velocity, and OOS risk should temper aggressive price moves. NIQ’s 2024 primers outline how these signals affect category performance and discoverability (NIQ – digital shelf overview, 2024).

- Quarterly omnichannel checkpoints: reconcile DTC ladders with retailer MAP, marketplace fees, and promo calendars. McKinsey’s 2024 “rewiring for digital and AI” notes the need for modular data products and cross-functional cadence to execute pricing consistently (McKinsey – rewiring for digital & AI, 2024).

Bottom line: DTC is your fast-learning lab, but it must coexist with wholesale realities.

KPI scorecard you can run every week

Track these consistently and tie them to specific packs and experiments:

- Commercial: Conversion rate, AOV, units/order, contribution margin %, LTV/CAC, churn.

- Elasticity/WTP: Elasticity by pack and segment, promo lift vs. baseline, halo/cannibalization.

- Digital shelf: Share of search, ratings volume/score, price parity index, OOS rate.

- Operations: Inventory turns, stockout rate, fulfillment cost/unit.

- Governance: MAP violations, time‑to‑remediate, EU unit price compliance rate.

| KPI Set | Example Target/Use |

|---|---|

| Contribution margin % by pack | Raise bottom quartile by 200–300 bps post-architecture change |

| Elasticity (core pack) | Keep within −0.8 to −1.4; re‑test if beyond range |

| Price parity index | ≥0.98 vs. key retailers while preserving MAP |

| Ratings volume (last 90 days) | +15% to support price moves |

Use weekly dashboards and a monthly review to decide: scale winners, tweak value messaging, or retire underperformers.

A pragmatic 6‑week PPA pilot plan (DTC-first)

Week 0: Align objectives, guardrails, and measurement (success criteria: margin bps, CVR, AOV, unit economics).

Week 1: Data QA and instrumentation (events, unit pricing labels, test cohorts, cost feeds). Baseline dashboard live.

Week 2: Design and launch two price tests on a core pack and a bundle. Lock promo calendar; set floors/ceilings.

Week 3: Monitor power and contamination; parallel build of two new packs (trial and value) with draft PDP copy.

Week 4: Read tests, update elasticity priors, finalize pack pricing; prep subscription offer (save‑with‑bundle logic).

Week 5: Launch new packs via phased rollout (10%→50%→100% traffic); run holdout.

Week 6: Post‑launch readout: unit economics by pack, cannibalization, shelf KPIs. Decision: scale, tweak, or kill.

Common failure modes (and how to recover)

- Overlapping promos nuke your price tests. Fix by freezing promos on tested SKUs and excluding contaminated sessions.

- Too many lookalike packs create paralysis. Rationalize with simple decision rules: unique value prop, incremental margin, and clear need-state. Evidence from revenue growth management practice shows SKU rationalization is often a prerequisite to profitability improvements in CPG DTC portfolios (SpeedyLabs – RGM in CPG).

- Ignoring digital shelf signals. If ratings drop or search share erodes, expect elasticity to harden; adjust pricing or improve PDPs before rerunning tests.

- Governance drift. MAP exceptions or inconsistent parity will trigger retailer friction; create a quarterly business review (QBR) for pricing with Sales and eCom.

Toolbox: AI-powered analytics platforms for PPA (DTC context)

- WarpDriven: AI-first ERP SaaS that unifies inventory, pricing, multi-channel sales, and predictive analytics—useful for experimentation logs, demand forecasting, and dynamic pricing guardrails. Disclosure: WarpDriven is our product.

- Mu Sigma CPG Portfolio Analytics: Custom modeling and portfolio simulation when you need bespoke elasticity frameworks; also a reference for why AI-enabled pricing improves margin agility in CPG (Mu Sigma – CPG analytics guide).

- Salesforce Consumer Goods Cloud: Strong field/promo workflows and CRM integration; best for DTCs tightly coupled with retail execution.

- SAP Data Intelligence: Heavy-duty data integration for complex enterprise stacks and hybrid retail–DTC environments.

Selection criteria: traffic scale, data stack complexity, need for custom models vs. configurable workflows, and degree of omnichannel coupling.

Practical workflow example: SKU rationalization & dynamic price testing using an AI-enabled ERP

Scenario: Your beauty DTC site has 62 active packs; 18 are near‑duplicates. You consolidate to 44 by eliminating low‑velocity, low‑margin overlaps. Then you run two price tests on the core 50‑ml and the value 150‑ml packs with floors set by unit economics and MAP.

Workflow: ingest DTC orders, shelf signals, and costs; estimate hierarchical elasticities; simulate cannibalization from retiring 18 packs; push new price ladders to the CMS with guardrails; monitor CVR, AOV, contribution margin, and parity in real time. Platforms like WarpDriven can operationalize this end‑to‑end by unifying pricing, inventory, experimentation logs, and API‑based price deployment while enforcing floors/ceilings. Disclosure: WarpDriven is our product.

Why it works: AI-enabled price/pack analysis shortens learning cycles and reduces promo-driven margin erosion. Industry guidance underscores that AI-powered portfolio/pricing analytics can improve margin agility for CPGs when combined with disciplined experimentation and governance (Mu Sigma – CPG analytics guide).

Templates you can lift

Pricing guardrails checklist

- Unit economics: target contribution margin % per pack, min order value for free shipping, returns impact

- Floors/ceilings: price floors by pack; MAP and parity constraints by channel; EU unit price labels where applicable

- Test hygiene: power analysis sheet, promo freeze windows, contamination checks, cohort definitions

- Release plan: phased rollout, holdout design, rollback criteria

Pack ladder skeleton (fill with your data)

| Tier | Format | Target Price | Unit Price | Role on Site | Notes |

|---|---|---|---|---|---|

| Trial | 1 x small | $9.99 | $/oz | Low-risk entry; sampling | Cross-sell to Core |

| Core | 1 x standard | $24.99 | $/oz | Everyday anchor | Subscription eligible |

| Value | 1 x large | $39.99 | $/oz | Stock‑up; basket builder | Watch cannibalization |

| Mission | Bundle | $49.00 | blended | “30‑day kit” | PDP storytelling |

Experiment readout snippet

Pack: Core 50‑ml

Test window: 2025‑04‑01 → 2025‑04‑28

Arms: $23.99 vs. $24.99

Traffic split: 50/50; n_sessions=120k; power=0.86 for 6% CVR delta

Result: +4.8% CVR (p=0.03), +2.1 pts contribution margin

Next: lock $23.99, update price ladder, re‑test bundle WTP in 6 weeks

Governance cadences that keep PPA healthy

- Weekly: experiment review; alerting for parity/MAP violations; stockout risk triage.

- Monthly: portfolio checkpoint—kill, scale, or tweak; A/B backlog; fresh elasticity reads for top packs.

- Quarterly: omnichannel pricing council with Sales, Retail Media, and Finance; reconcile DTC and retailer calendars; reset floors/ceilings as COGS shifts. 2024 guidance on RGM cadence and digital rewiring highlights the importance of cross-functional operating rhythms (McKinsey – rewiring for digital & AI, 2024).

Closing thought

PPA is a system, not a one‑off project. When your data plumbing is sound, tests are disciplined, and governance is real, the DTC site becomes a compounding asset—learning faster than competitors and converting that into profitable growth.