Why Split-Funnel Analysis Matters for Mobile Checkout in 2025

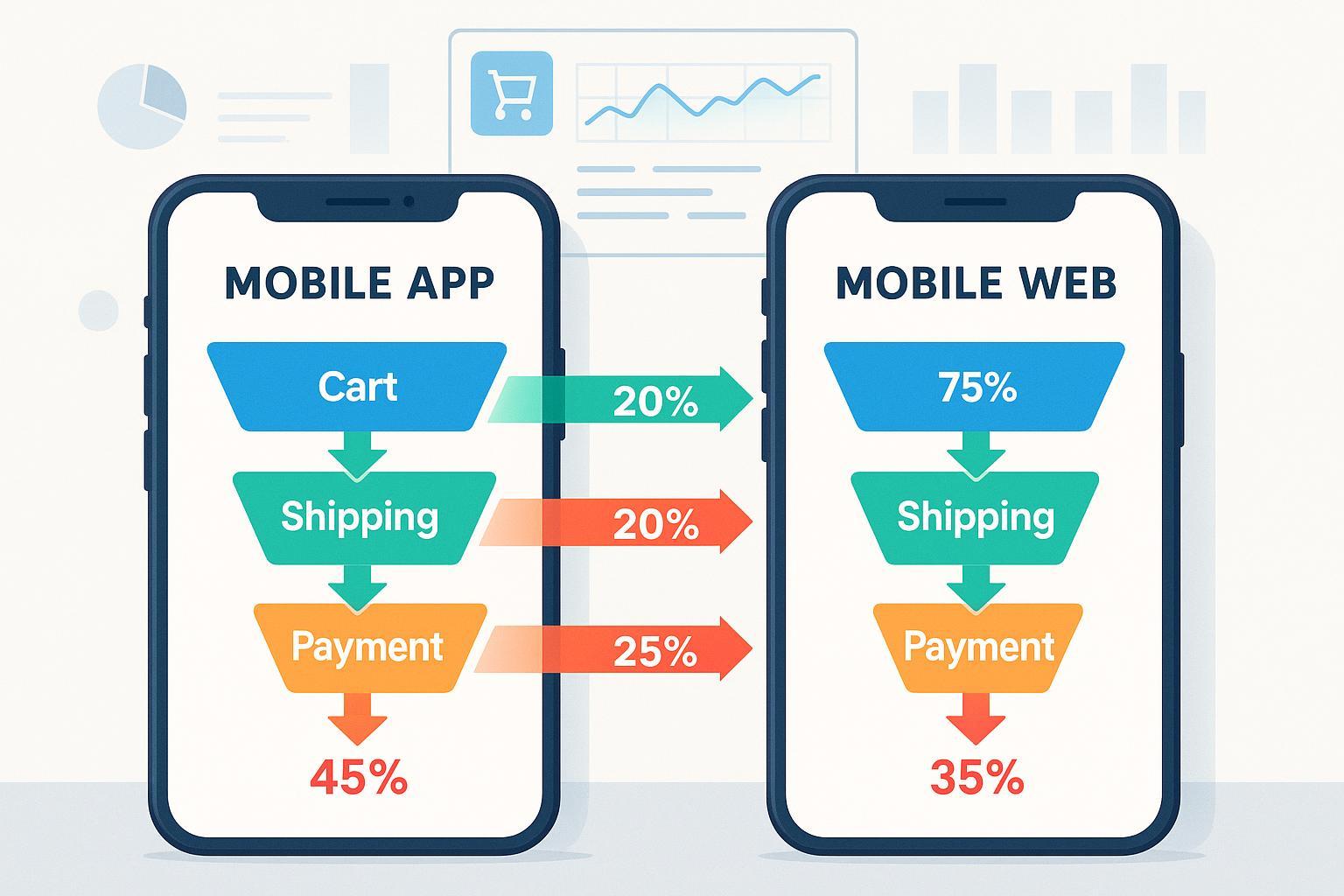

With mobile commerce now driving over 68% of eCommerce traffic (VennApps), choosing between mobile app and mobile web as the primary checkout channel is a strategic decision for retailers, D2C brands, and digital product businesses. Split-funnel analysis—quantitatively breaking down each step in the checkout process—uncovers not just where users drop off, but why, fueling targeted optimizations that boost conversion, reduce friction, and shape smart channel investments.

This review delivers the industry's most actionable, stepwise comparison of mobile app vs mobile web checkout performance in 2025, grounded in the latest conversion benchmarks, user experience research, and real-world business scenarios.

Split-Funnel Checkout: The Step-by-Step Showdown

For each major stage of checkout, we'll compare app and web performance metrics, user friction, and optimization tactics, supporting claims with current data and sources.

Step 1: Cart / Add-to-Cart

| Channel | Conversion (2025) | Friction Points | Notable Benchmarks |

|---|---|---|---|

| Mobile App | ~1.39% install-to-purchase rate | Choice paralysis, cross-sell overload | UXCam |

| Mobile Web | ~77.34% cart abandonment | Slow load, small tap targets, clutter | ConvertCart |

Insight: Mobile apps offer a smoother cart experience, but risk overcomplicating choices. On web, visual clutter and small tap targets create disproportionate abandonment.

Actionable Tactics:

- App: Reduce cross-sell noise; prioritize sticky navigation and auto-applied coupons.

- Web: Enable guest checkout, optimize tap targets, declutter visuals.

Step 2: Shipping / Address Entry

| Channel | Completion Speed | Friction Points | Best Practices & Data |

|---|---|---|---|

| Mobile App | Faster, autofill/autocomplete | Manual entry errors | Baymard Institute |

| Mobile Web | Slower, browser autofill varies | Tedious field inputs | Contentsquare |

Insight: Apps leverage built-in autofill and validation for snappier completion. Web forms often lag and are more error-prone, with about 10-15% slower completion (NitroPack).

Actionable Tactics:

- App: Integrate express pay, auto-advance, and address verification.

- Web: Use progressive disclosure, browser autofill, clear error messaging.

Step 3: Payment Selection & Entry

| Channel | Conversion Rate | User Trust & Friction | Benchmarks & Insights |

|---|---|---|---|

| Mobile App | 10-15% higher completion | Secure, saved cards, native wallets | NitroPack |

| Mobile Web | Lower than app; major drop-off | Card entry fatigue, trust concerns | ConvertCart |

Insight: Apps win on payment with express checkout (Apple Pay/Google Pay), while web checkout suffers from manual card entry and consumer skepticism.

Actionable Tactics:

- App: Promote wallet and express pay options, simplify forms.

- Web: Shorten payment forms, offer express pay, clarify security.

Step 4: Review & Edit Order

| Channel | Abandonment Rate | UX Quality & Friction | Best Practices & Data |

|---|---|---|---|

| Mobile App | Lower abandonment | Smooth UI, inline edits | Ping Identity |

| Mobile Web | Higher abandonment | Clutter, ambiguous progress | ConvertCart |

Insight: Mobile apps provide clear inline editing with less distraction; web often falters with cluttered interfaces and unclear progress, leading to increased drop-offs.

Actionable Tactics:

- App: Maintain clear progress bars and inline editing.

- Web: Streamline review screens, enhance progress visibility.

Step 5: Order Confirmation & Post-Purchase

| Channel | Engagement & Loyalty | Speed & Reliability | Benchmarks & Insights |

|---|---|---|---|

| Mobile App | High repeat engagement | Instant push notifications | ConvertCart |

| Mobile Web | Lower engagement, slower | Confusing confirmation UX | NitroPack |

Insight: Apps excel at immediacy with push notifications and loyalty prompts. Web confirmations often lack clarity and after-sale engagement tools.

Actionable Tactics:

- App: Send real-time order confirmations and reward prompts.

- Web: Clarify order summaries, introduce post-purchase cross-sell or feedback.

Industry Dashboard: Conversion and Abandonment Benchmarks (2025)

| Channel | Avg. Conversion Rate | Cart Abandonment Rate | Key Notes |

|---|---|---|---|

| Mobile Web | 1.8%–2.9% | 77%–85.65% | High traffic, lower conversion |

| Mobile Apps | ~4.6% | ~20% | 157% higher conversion vs web |

| Desktop | ~4.8% | ~68% | Desktop leads overall |

App users spend 15% more per order than web shoppers (VennApps).

Regional Variation: North America sees mobile cart conversion rates at ~3.4%, Asia at ~2.9% (Network Solutions).

Guest Checkout, Express Pay, and Recovery Tactics: Real-World Cases

- Guest Checkout: Brands like USCutter reduced cart abandonment by 51% and increased conversion by 12% using frictionless guest checkout (Case Study).

- Push Notification Recovery: In-app order reminders and recovery flows (Happy Box’s retention strategy) improved engagement and reduced drop-off (Tidio).

- Express Pay & Cross-Device Handoffs: Industry practice shows express payment options can lift conversion 20–30%, with omnichannel (web-to-app) strategies supporting higher completed checkout rates (Barn2).

Optimization Strategies at Every Funnel Step (2025)

| Funnel Step | Mobile App Tactics | Mobile Web Tactics | Potential ROI/Impact |

|---|---|---|---|

| Cart | Sticky nav, auto coupons | Guest checkout, offer pop-ups | 20–30% conversion lift possible |

| Address | Autofill, address validation | Progressive fields, autofill | 10–15% faster, fewer errors |

| Payment | Native wallets, saved cards | Express pay, clear CTAs | 10–15% conversion increase |

| Confirm | Push notifications, loyalty | Order summary, feedback prompts | Higher repeat purchase |

Sources: NitroPack, ConvertCart, WP Rocket

Key Takeaways for eCommerce Leaders (2025)

- Mobile app checkouts consistently outperform mobile web on conversion, abandonment, and post-purchase engagement—but require higher initial investment and ongoing maintenance.

- Mobile web remains essential for reach and fast onboarding. Guest checkout and express pay are must-have optimizations to raise its competitive performance.

- Split-funnel analysis reveals that friction at address and payment stages accounts for the majority of web losses. Tackling these pain points is the fastest path to ROI on both channels.

- Hybrid and omnichannel strategies—such as integrating web-to-app handoffs, recovery emails/SMS, and personalized push notifications—offer the strongest business outcomes.

- Segmented conversion tracking (guest vs. logged-in, new vs. repeat users) enhances optimization, though full public benchmarks per funnel step are rare; custom analytics are advised for deeper insight.

Decision Framework: Mobile App or Mobile Web?

- Invest in Mobile App if your brand seeks higher repeat engagement, loyalty programs, personalized recommendations, and you have the resources for app lifecycle management.

- Double-down on Mobile Web for broad reach, lean funnels, and fast guest conversions—key for brands with high first-time buyer volume or limited tech resources.

- Embrace Hybrid: Leverage both channels with cross-device tracking, recovery flows, and unified analytics for maximized results.

Further Reading & Benchmarks

- Mobile App Conversion Rate Benchmarks & Tips for 2025 — UXCam

- Ecommerce Mobile Conversion Rate Best Practices (2025 Guide) — Appbrew

- 32+ Ecommerce Mobile App Statistics — Mobiloud

- What’s a Good Mobile Ecommerce Conversion Rate in 2025 — Convertcart

- 35 Essential Stats on Mobile Commerce in 2025 — VennApps

Conclusion:

Split-funnel analysis provides a powerful lens for eCommerce teams to understand, diagnose, and optimize mobile checkouts. By segmenting friction, benchmarking conversion, and applying tactics at each step, brands can make confident, data-driven channel decisions for 2025 and beyond.