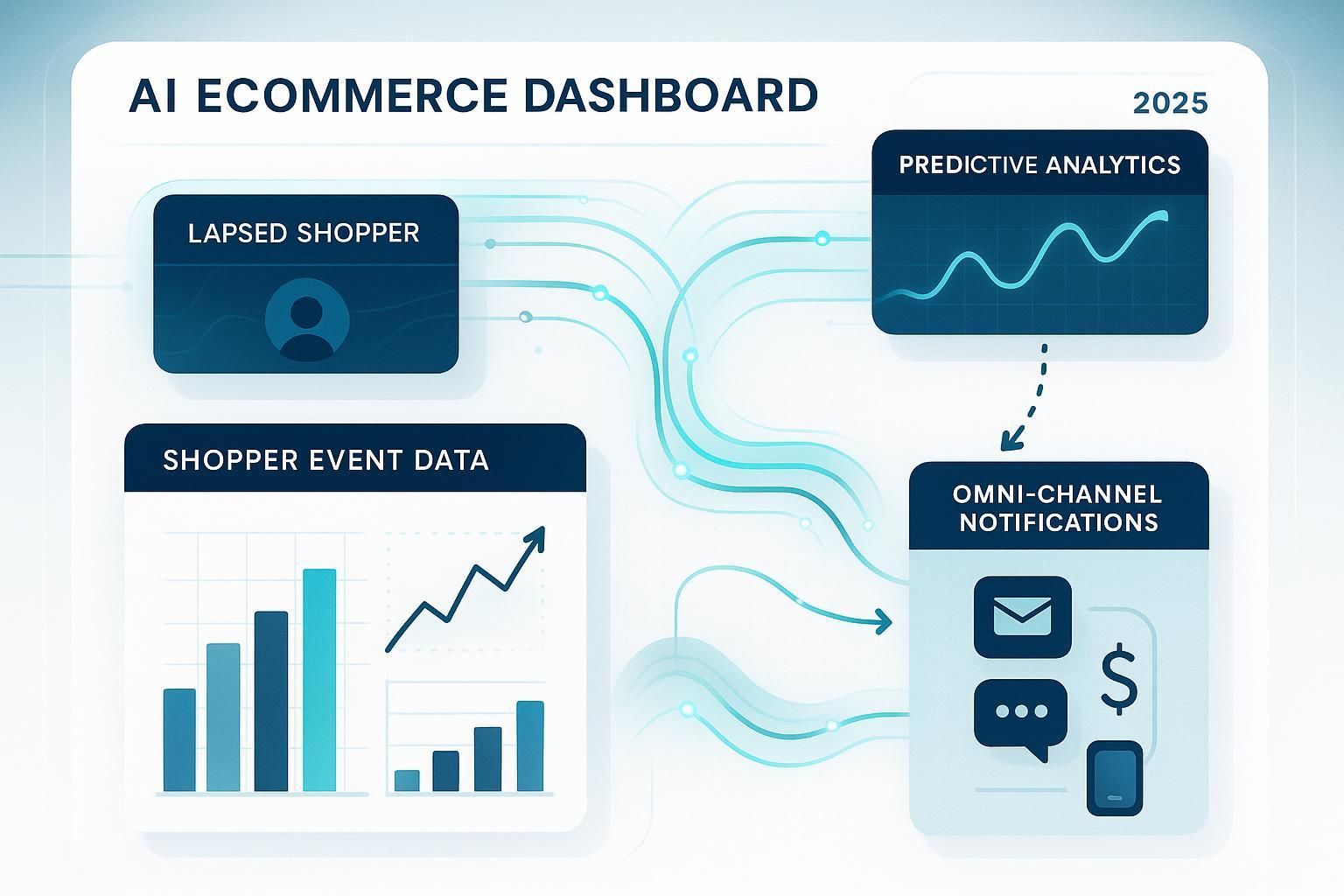

Lapsed shoppers are no longer a lost cause. In 2025, AI-powered next-best action (NBA) strategies—grounded in unified event data—are turning reactivation into a precise, measurable science. As someone who's built and run NBA programs for leading eCommerce brands, here’s the hands-on guide you won't find on typical competitor blogs: tactical frameworks, quantified results, real-world pitfalls, and the rapidly evolving AI edge.

The 2025 Context: Why NBA for Lapsed Shoppers Is Mission-Critical

Shopper acquisition remains expensive, repeat purchase rates are flatlining, and legacy retargeting grows less effective with tightening privacy rules. According to the Moloco RMG Creative Best Practices 2025, dynamic NBA-triggered campaigns are now delivering up to 15% ROAS lift and 12% lower CPA for lapsed segments—if executed well.

What's different in 2025? The surge of agentic AI, omnichannel orchestration, and frictionless data integration means NBA can now adapt in real time to micro-behaviors. But real impact only comes with practitioner-level system design, not theory.

Stepwise Framework: Field-Tested NBA for Lapsed Shopper Reactivation

1. Aggregate and Unify Event Data Streams

- Sources: Server-side tracking via Google Analytics 4 (GA4), Mixpanel, Amplitude for web visits, cart events, purchases, customer service chats, returns, cross-channel engagements.

- Integration Tips: Unify all sources in a normalized dashboard (Daasity, Glew.io, Saras Pulse) and maintain strict event taxonomy—otherwise, NBA signals will fragment and degrade.

- Common Mistakes: Data silos. In every failed NBA pilot I’ve seen, scattered event feeds and duplicated profiles were the #1 root cause of wasted activation budgets.

2. Segment and Identify "Lapsed" Shoppers

- Definition: Set inactivity thresholds tailored to business cycle (e.g., 30, 60, 90 days) by segment—high-value, seasonal, or high-frequency buyers all lapse at different rates.

- Segmentation Model: Clustering by recency, frequency, value, and behavioral signals. Leverage ML-based clustering via open-source tools (Scikit-learn, PyCaret) or cloud AI APIs.

- Practical Note: Over-segmentation dilutes reactivation impact. Pair persona clusters with 1–2 key behaviors, not 15 micro-groups (see Zozimus NBA Marketing for Biotech).

3. Build and Deploy Predictive NBA Models

- AI/ML Choices: 2025 NBA leaders use reinforcement learning, gradient boosting, or agentic AI platforms to dynamically score NBA likelihood, not just static triggers. Real-time input matters: don’t just rely on last purchase, but time since last session, engagement paths, and opt-out history.

- Tool Landscape: Nosto, Wisepops, Optimonk for recs; DIY with TensorFlow Lite or MLflow for custom pipelines. Always validate against your own data—pretrained models often misclassify intent for small/vertical shops (Graphite Note: Predictive Models).

4. Generate Personalized NBA Content & Offers

- Personalization Levers: Dynamic discounts, relevant products, time-limited perks, tailored reminders, guided landing experiences. Leading practitioners simulate "in-store conversation"—using live bots for high-value segments, or AI-driven email drip for lower tiers.

- Real Example: On-site pop-ups via Wisepops or Optimonk trigger when an inactive shopper lands, offering a one-time callback or reminder; email NBA wins back dormant users with recovery rates tied directly to personalization strength.

- Pro Tip: Personalization fatigue is real; rotate message types and channel mix to avoid immediate opt-outs (Queue-it Blog: Product Drop).

5. Activate NBA Across Channels—Optimize Timing and Frequency

- Orchestration Stack: Email, SMS, push, on-site overlays, chatbots, retargeting ads. Use orchestration tools (Braze, Customer.io, open-source Airflow) to sequence and cap interactions, ensuring reach without spam fatigue.

- Channel Best Practices: Mobile-first NBA is essential—60%+ reactivations in 2025 originate from mobile channels (Marketing Dive: Predictions for 2025). Time NBA outreach within 24–48 hours after “lapse detected” event for best conversion.

6. Measure, Close the Loop, and Iterate

- Metrics to Track: Reactivation rate (pre/post NBA), ROAS uplift, CPA drop, churn delta, CLV expansion. Never rely on "open rates" alone—map conversion to NBA-activated touchpoints.

- Feedback Practice: Retrain ML models quarterly based on response curves. Integrate feedback to iterate NBA triggers (e.g., shift from discount-heavy to value-driven offers if ROI drops).

- Live Case Insight: Moloco’s event-driven NBA program saw A/B-tested reactivation lift at 15% ROAS improvement (Moloco RMG Creative Best Practices), with dynamic offer rotation outperforming static emails by 27%.

Deep Dive: Real-World Examples and Quantified Results (2024–2025)

- AppLovin NBA Mobile Ads: Used NBA-tied mobile video for lapsed users with 100+ prior touchpoints, driving measurable ROAS and significant reactivation—though exact rates remain proprietary (Northbeam: AppLovin Performance).

- Amazon: ~35% of total revenue now attributed to NBA-driven recommendations for both active and dormant segments (Mobisoft: AI Strategies 2025).

- General Retention Principle: AI-driven NBA programs consistently improve repeat purchase rates and CLV by 10–20% or more, per leading market syntheses (Digital Marketing Strategy Textbook).

Vendor-Neutral Tools for Data and Activation (2025)

- Data Collection: GA4 (server-side events), Mixpanel, Amplitude, Heap for event streams; Shopify/WooCommerce native analytics for purchase/lapse signals.

- Integration: Saras Pulse, Daasity, Glew.io for cross-channel dashboards. Stape.io for robust server-side event performance.

- NBA Orchestration: Braze, Customer.io, Airflow, or open-source orchestration platforms; Nosto for ML-driven personalization; Wisepops/Optimonk for on-site engagement.

- Privacy-First Analytics: Piwik PRO for GDPR/CCPA compliance—a no-brainer if you serve regulated regions.

Common Pitfalls (and How to Avoid Them)

| Pitfall | Impact | Mitigation |

|---|---|---|

| Over-segmentation | Diluted activation, wasted spend | Persona clusters with key behaviors only |

| Messaging fatigue | Disengaged list, opt-outs | Cap frequency, rotate channels/messages |

| Data silos/model drift | Poor NBA targeting, stale offers | Unified dashboard, retrain models quarterly |

| Privacy compliance gaps | Legal risk, trust erosion | Use first-party, privacy-centric platforms |

| Channel fragmentation | Lost conversions | Centralized orchestration with attribution |

| Bot interference | Skewed NBA metrics | Credential checks, invite-only, validation |

Source references: Zozimus NBA, Queue-it Blog, Saras Analytics, UXCam Event Analytics

Emerging Trends for NBA in 2025: What Actually Matters

- Agentic AI & RL: Autonomous shoppers get interventions personalized at every micro-interaction via reinforcement learning. The best NBA stacks now adapt offers depending on real-time returns/churn signals, not just static history (Djust: AI Customer Analytics).

- Omnichannel, Mobile-First: 2025’s win-back leaders orchestrate NBA across channels, but especially prioritize mobile, in-app, push, and thumb-friendly experiences.

- Privacy-by-Design: Compliant by default—not an afterthought. Consent management, event-level anonymization, and transparent messaging are now table stakes (Stape.io: Performance Analytics).

- Interactive, Visual NBA: AR/VR, conversational bots, and live visuals drive re-engagement with lapsed shoppers for high-value segments (Storyblok: Ecommerce Best Practices).

Sidebar: Privacy-by-Design NBA—How Not to Get Burned in 2025

With privacy law tightening—GDPR, CCPA, and emerging global regulations—NBA programs must:

- Use first-party data, minimize dependency on third-party trackers

- Serve only well-consented, anonymized event pools

- Choose analytics/tools (Piwik PRO, server-side GA4) built for strict governance

- Communicate data usage and NBA intent clearly up front (not buried in T&Cs)

Industry leaders now treat privacy as differentiation, not just compliance—building trust by letting shoppers manage NBA preferences and outreach frequency themselves.

Key Learnings & Optimization Playbook

- Iterate ruthlessly: NBA impact at launch rarely equals long-term ROI; quarter-by-quarter feedback and offer rotation are critical.

- Benchmark honestly: Measure lift vs. prior periods and against NBA-free control groups (A/B testing).

- Share what flopped: In my own pilot NBA for dormant luxury buyers, initial high-discount outreach cratered CLV; switching to value-creation content (guided product discovery, loyalty perks) doubled retention over six months.

- Stay current: Platforms and shopper behaviors shift every season. What works in Q1 might stall in Q3—embed quarterly NBA strategy reviews as standard practice.

Final Word: NBA Best Practices Are Iterative, Not One-Size-Fits-All

Every lapsed shopper segment is different. NBA best practices hinge on your business’s data quality, segment value, and engagement levers—not some universal blueprint. What powers success in one retail domain may flop in another. Use these frameworks to start, but let your own results and feedback shape the next iteration.

2025 is the year NBA for lapsed shoppers goes from tactical band-aid to core retention engine—if you run the right data, segmentation, AI, and privacy playbook.

Ready to take action? Audit your event data flow and NBA orchestration this week, pair insights with fresh practitioner benchmarks, and build your own lapsed shopper win-back model for sustained growth.